|

2000 Best Practice Awards"Local" Winners: Montana State Office

2000-81 Sage Tower Retirement Apartments

and Prairie Tower Aparments Neighborhood Networks

Sage Tower Retirement Apartments is a 236 HUD Assisted

Low Income Elderly Complex with 111 units 52 which are section 8. Prairie

Tower Apartments is a 202 HUD assisted low income Sage Tower Retirement Apartments is a 236 HUD Assisted

Low Income Elderly Complex with 111 units 52 which are section 8. Prairie

Tower Apartments is a 202 HUD assisted low income  Elderly/Handicapped with a total of 105 Units which

are 100% Section 8. Both of these apartments are located in Billings, MT. Elderly/Handicapped with a total of 105 Units which

are 100% Section 8. Both of these apartments are located in Billings, MT.

2000-89 Montana Preservation Project

Eight apartment complexes scattered throughout

western Montana were sold to non profit sponsors preserving their affordability

to lower income households with out a fixed expiration point in the future.

One of the eight was transferred separately using tax credits, CDBG, HOME

and Affordable Housing funds prior to the package of the remaining seven.

This Best Practice recognizes the package of seven. The most significant

part of the package is the maintaining of the Sec. 236 interest reduction

payment by dropping the FHA insurance available to five complexes and moving

the mortgage into second position to a risk share first position mortgage.

The purchase and the $3.6 million in rehabilitation were financed $9.2

million in first mortgages, $4.16 in tax credit proceeds, $2.9 in second

mortgages, $1.43 from the Federal Home Loan Bank, and $111,000 in seller

held paper.

2000-90 Small cities HOME CDBG

The State of Montana

Department of Commerce provides comprehensive housing training across the

state each year. This training covers not only the basics in applying for

housing funds from either HOME or CDBG but also information on tax credits,

Rural Development, and HUD programs. The most significant part of this

training is the training provided by the HUD funded TA contractor. Individuals

and groups considering special housing projects in their community are

given basic information of determining feasibility and gaps. Working as

a group each project is analyzed to determine what type of housing is needed

and what programs are available to fill the financing gaps. The cost figures

for this project reflects three sessions in a given year. It does not include

state employee staff time or travel. The State of Montana

Department of Commerce provides comprehensive housing training across the

state each year. This training covers not only the basics in applying for

housing funds from either HOME or CDBG but also information on tax credits,

Rural Development, and HUD programs. The most significant part of this

training is the training provided by the HUD funded TA contractor. Individuals

and groups considering special housing projects in their community are

given basic information of determining feasibility and gaps. Working as

a group each project is analyzed to determine what type of housing is needed

and what programs are available to fill the financing gaps. The cost figures

for this project reflects three sessions in a given year. It does not include

state employee staff time or travel.

2000-105 Loan Leveraging with Mortgage Fun Set

The Montana Board of Housing, Montana Rural

Development, and Montana HUD established a program to get the most loans

out of the limited funds available through the tax exempt bond financing

available through the Montana Board of Housing and the direct loan authority

available through Rural Development and serve the lowest possible income

families in buying homes. The Montana Board of Housing reserved a portion

of recycled mortgage fund at 6% interest for use with second mortgages

funded through 1% -3% 502 direct loans through Rural Development. The first

mortgages are FHA insured loans created through private lenders and purchased

by the state board of housing with the second mortgage(designed to go up

to 50% but has gone as high as 90%) funded by the local Rural Development

office.

2000-139 Fairview disaster

At noon March 16th 2000 an explosion in a

garage in the small community of Fairview Montana destroyed seven homes

and displaced two other families. As the community is divided by the Montana

North Dakota border four of the destroyed homes were in North Dakota and

three in Montana. The nine families were in a state of shock with the loss

of their home. The executive director of the Richland County Housing Authority

went to Fairview the afternoon of the explosion identifies available housing

owned by the authority and conferred with the Red Cross. Five of the nine

families were eligible for low income housing . two were elderly and went

with relatives and three were housed by the Richland County Housing Authority.

2000-140 Montana Fair Housing - Accessibility Adv

Individuals, with the support of Montana

Fair Housing Inc. and the Summit Independent Living Center, filed suit

against the developer ownership group in Federal Court. Montana Fair Housing

provides front-end costs for this effort through the residuals of an earlier

HUD enforcement grant and their own capital. At this date the exact amount

of these funds is not available.

2000-162 Off Net Picture Tel

The HUD PictureTel system is normally used

to communicate within the HUD organization. In the Rocky Mountain Region,

however, this system has been used for program implementation and communicating

with clients in the remote areas of the region. This has been accomplished

through bridging between the HUD Picture Tel system and the other commercial

services. In Montana, for example, the MetNet system is the typically bridge.

This education-based system allows live video consultation between elected

and staff officials within a community and HUD program staff in Denver.

Using off network video, HUD has been able to connect government agencies,

community colleges, tribal colleges, universities, and hospitals with the

appropriate HUD staff in the region. HUD has helped to facilitate an awareness

of other’s needs in the region that would not exist with out this

capacity.

The result of this effort has been a new

level of communication amongst groups that in the past, was unobtainable

(and doing so at an affordable cost).

2000-189 Our House and the Spurlock Apartments

Our House and the Spurlock Apartments include

a 6 bedroom transitional group home and 8 studio/one bedroom apartments

which provide affordable supportive housing for adults with mental illness.

All residents earn between 0-25% of median income, with the majority earning

less than 25% of median income. Resident services include a broad range

of mental health supportive services including training in daily living

skills, i.e., cooking, budgeting, cleaning, personal hygiene, medication

management, prevocational training designed to promote community reintegration

and successful independent living. A resident council participates in on-site

management.

2000-362 Montana Homeownership Network

Neighborhood Housing Services of Great Falls

is the "point" organization for funneling resources for a statewide

rural housing collaborative. The NHS began working with local lenders and

Realtors to put families into homes in 1986 as a neighborhood revitalization

strategy. Realtors found the buyers and NHS procured a reservation of 6%

first mortgage monies from the Montana Board of Housing, the State’s

finance agency. The local lenders then packaged the mortgages. In recent

years, the Great Falls NHS has added down payment assistance from various

grants and homebuyer education to the program and provided this service

citywide in Great Falls. The Montana Board of Housing (MBOH), the state

finance agency, a major partner in all of the NHS programs, has provided

over $19 million to NHS in set asides of thirty year first mortgages at

a 6% annual interest rate, HUD would then insure the mortgage with their

FHA single family loan product. In 1996 the seven Resource, Conservation

and Development (RC&D) Areas, non-profit organizations which are part

of the Natural Resource Conservation Service and an arm of the United States

Department of Agriculture, surveyed Montana and found, to their surprise,

that affordable housing, an area in which they had not worked, was a major

statewide need in rural Montana. The Coordinator of the North Central Montana

RC&D Area became aware of the Great Falls NHS program and requested

assistance with developing a program to meet their housing needs. At the

same time, Neighborhood Reinvestment was saying to NHS, we can’t afford

to set up more NHS organizations in huge, sparsely populated states like

Montana; see if you can find other ways to help rural communities. This

resulted in a pilot project in a ten county area the size of the State

of South Carolina, whereby the RC&D Coordinator was trained by Neighborhood

Reinvestment at its national Training Institute to facilitate homebuyer

training courses and was coached by the Great Falls NHS on how to market

homebuyer classes and to work with their local Realtors and lenders on

utilizing NHS down payment and first mortgage programs. Neighborhood Reinvestment

provided $35,000 to NHS for the down payments and Montana Board of Housing

provided 6%, 30 year, FHA mortgages. Fourteen families were helped to buy

homes. This was so successful that the State RC&D Association Board

of Directors asked that the NHS phase in the other six RC&D Areas for

a similar project. This has been done, two by two, and the last two RC&Ds

are just beginning to market their programs. It takes about a year to get

the homeownership programs up and running. It is not surprising that the

RC&Ds would be excellent at marketing and educating buyers in rural

areas. These are the territories they regularly cover and the people with

whom they traditionally work. What has been surprising is how fast the

program has grown in small towns, where word of mouth markets the program

at lightning speed. One other organization that has brought great strength

and knowledge to the partnership is Montana’s Rural Housing Services.

They, too, are experts in delivering rural programs and covering vast areas.

Additionally, they bring housing expertise and a number of very effective

first mortgage products to the rural customer. These products are the Rural

Development guaranteed loan program and special Rural Home Loan Partnership

national set asides. In addition, in partnership with HUD’s single

family mortgage insurance program they have a loan leveraged program with

the Montana Board of Housing, where MBOH takes the first half of the first

mortgage loan at 6% with a down payment and RD takes the other half with

no down payment and interest rates as low as 1% and FHA insures the mortgage.

This results in loans with annual percentage rates as low as 3 to 4%, depending

on income, making homes affordable for very low-income rural Montana families.

Of particular note is that Rural Housing Services has put together a way

to lend on Indian Reservations. A project currently in mid-stream is the

move and rehab of fifteen homes from Malmstrom Air Force Base in Great

Falls to the Fort Belknap Reservation. The North Central Montana RC&D

has provided the prospective buyers with homebuyer education, Great Falls

NHS will provide the capital for the down payment assistance and Rural

Housing Services will make the first mortgage loans. This is a good example

of how this partnership routinely figures out how to do the "undoable

deal". Since the Great Falls NHS began its homeownership promotion

program, more than one thousand lower income families have been helped

to buy homes and NHS has closed over $19 million in MBOH/FHA and $2 million

in RD first mortgages. In addition, more than $18.5 million first mortgage

loans have been leveraged by the NHS Lender Pool Loan fund for second mortgages

for unbankable families over 80% of median income in the Great Falls area.

The numbers on all programs have increased dramatically as the partnership

expanded to rural communities. In the last three years over 255 loans have

been made in rural communities. Homebuyer education and/or assistance with

loans for down payment and closing costs for home purchase have been offered

in seventy-one communities in Montana since the inception of the NHS rural

program. Homebuyer education is an essential part of the statewide program.

Buyers and potential buyers receive training in the entire home purchasing

process. The homebuyer course includes segments on budgeting, credit (how

to establish good credit, how to repair poor credit), understanding credit

reports, the mortgage loan application process, working with a Realtor,

what to look for in a house, understanding and filling out the Purchase

and Sale Agreement, the home inspection and appraisal, the importance of

homeowners hazard insurance, what title insurance covers, the loan closing

and the final settlement statement (HUD I). Homebuyer education is required

for all homeownership loans made by NHS. Three NHS staff members and all

seven RC&D Coordinators have been trained at Neighborhood Reinvestment

Training Institutes and have received their Homebuyer Education Certificates.

Three of the staff of NHS of Great Falls are also certified in Full-Cycle*

Lending having obtained the Mortgage Lending Certificate, as well, which

includes classes in first mortgage lending, loan servicing and collection,

compliance with State and Federal regulations and foreclosure prevention.

The seven RC&D Coordinators are now beginning to take the foreclosure

prevention course at Training Institutes. It is anticipated that when a

home maintenance course is added to the curriculum, this training will

also be provided by Neighborhood Reinvestment to the RC&D staff, as

well as the NHS staff. Another key factor is that all properties must pass

qualified appraisals before NHS will provide financing. This means that

all necessary repairs are done by the seller, prior to closing. Amazingly

enough, the process works as smoothly all over the state as it did in Great

Falls. The rural Realtors and lenders work with the buyers and send their

loan packages to NHS; homebuyer education is provided by RC&D Coordinators

in, or close to, the buyer’ home town, either before or after they

see a Realtor or a lender; appraisals are completed; below market first

mortgages are provided by MBOH, RHS or private lenders; and NHS checks

the specific grant requirements, packages the second mortgage and sends

the loan documents and the check to the closing agent for settlement and

filing. Everyone doing what they do best!

2000-380 Lolo Economic Development Initiative (aka Travelers' Rest Preservation

Project

What was to become one of Montana’s

first Rural Housing and Economic Development initiatives actually began

with congressional funding of the Lewis and Clark Expedition to explore

and map the territory (including all of what was to become the State of

Montana) acquired from the French through the Louisiana Purchase. As both

the Nation and Montana prepare for the Bicentennial Celebration of the

Lewis and Clark Expedition, it is fitting that a HUD Rural Housing and

Economic Development Grant Program plays a significant role. The program

not only addresses economic needs and opportunities of the rural area but

also encourages the preservation of Lewis and Clark’s most important

Montana campsite and the centuries-old trail junction also used by Nez

Perce, Confederated Salish and Kootenai, and Shoshone-Bannock Tribes. The

following is a quote from the journal of Captain Meriwether Lewis, September

9, 1805: "as our guide inform me that we should leave the river at

this place and the weather appearing settled and fair I determined to halt

the next day rest our horses and take some celestial observations. we called

this Creek Travelers rest." (To read more about the Travelers’

Rest Project go to: http://www.travelersrest.org/) Thus, with its beginnings

dating back almost 195 years, The Lolo Economic Development Initiative

(AKA)Travelers' Rest Preservation Project is today’s community effort

to stimulate the local economy of this important crossroads and to provide

employment opportunities for area residents. HUD’s Rural Housing and

Economic Development Program Seed Funding (FY1999) Grant to the Montana

Community Development Corporation addresses the economic/job creation needs

in the community of Lolo, Montana. The Lolo Economic Development Initiative

project, having achieved its initial goals, is now referred to as the Travelers'

Rest Preservation Project (TRPP). The TRPP has three main components: 1.

Establishing a Lolo community non-profit economic development entity (LDC).

The HUD RH/ED Grant has been used to develop an organization with the capacity

to develop and implement economic development priorities and strategies

anchored by the Lewis and Clark Travelers' Rest Heritage Tourism Project.

Seed funds used for: · Organization planning including recruiting

leadership and staff. · Organizational start-up and legal work to

establish organization. · Establishment of Office and Office location.

· Beginning outreach and communication activities including developing

a WEB page, a brochure, newsletter; developing and drawing media coverage;

preparing presentations to Lolo Community Council, lenders, potential funders.

To include grant writing and relationship building with funding sources,

potential partners, government, like organizations. · Development

of a Strategic Plan for the Organization to include fundraising plans,

marketing plans, operating budgets and plans. · Development of training

program for employees of new corporation. · Development of leadership

capacity. · Attendance at National conferences on economic development

and heritage tourism. 2. Developing a plan for the Travelers' Rest Heritage

Tourism Project in Lolo as the "anchor" project for the non-profit

entity. Funds to be used for the following activities related to development

of this project: · Complete historical and archaeological investigations

of the site. · Prepare concept development for the project. This

will involve preparing RFPs to consultants, evaluating and awarding a contract

for design services. To include working closely with the community to develop

at least three concept design alternatives and one selected alternative,

site evaluation of designs, market feasibility for the design alternatives,

and construction estimates. · Prepare operating plan for the project.

· Consult w/the Native American Tribes on issues in concept development

for the project. · Public participation and Agency cooperation.

Work closely and coordinate with the community and regional and state agencies

on project conceptualization. Public involvement to include extension of

community planning for the site/visitor center/satellite facilities and

services related to the site development and use. · Publish Project

Concept Plan. · Raise funds for project development and construction.

3. Developing a Lolo Economic Development Plan and Strategy. Because the

Lewis and Clark Travelers' Rest Heritage Tourism Project is an important

anchor for the community, tourism will be one focus of this plan. The following

activities will be included in the development of the Plan and Strategy:

· Community needs assessment of businesses and individuals related

to economic development to include an identification of needs, opportunities,

resources, and priorities. · Income survey. · Action Plan

for implementing priorities. · Community involvement/public participation

necessary to develop the ED Plan. · Fundraising to implement strategies

per the Action Plan. All three project components are interrelated and

will be implemented over a two year period. Success, in part measured by

development of satellite activities related to the project, will depend

on the effectiveness of the LDC formed to develop and implement long term

economic strategies for the entire community. In turn, the start-up and

success of this local non-profit (LDC/CDC) will need the Travelers’

Rest Heritage Tourism Project as an anchor to afford the organization some

long term stability. The community economic development plan and strategy

created by the newly formed LDC in partnership with the County Government

will provide the community with the necessary structure to implement particular

economic development strategies with heritage tourism as a base.

2000-1613 Tim Kelly

Tim Kelly is a private attorney who represents

plaintiffs and or aggrieved parties in federal or state civil rights actions.

About 30-40 percent of this practice involves claims brought under the

federal Fair Housing Act.

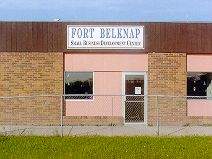

2000-1912 Fort Belknap College Small Business Development Center - Business

Incubator

Fort Belknap College, in Harlem, MT, was

awarded a FY 1999 Rural Housing and Economic  Development Grant in the amount of $200,000 to establish

a Business Incubator on the Fort Belknap Indian Reservation in conjunction

with the Fort Belknap College Small Business Development Center. The Business

Incubator will be used to build and enhance the capacity of the Business

Development Center to assist aspiring entrepreneurs to establish small

businesses based on the reservation which will employ area residents. The

Fort Belknap Small Business Development Center - Business Incubator has

been a successful, albeit limited program offered by the Fort Belknap Community

College for several years. It is funded by the Tribal Community Business

Council and the U.S. Department of Commerce - Small Business Administration.

In the past it has been staffed principally by only a Director and an assistant. Development Grant in the amount of $200,000 to establish

a Business Incubator on the Fort Belknap Indian Reservation in conjunction

with the Fort Belknap College Small Business Development Center. The Business

Incubator will be used to build and enhance the capacity of the Business

Development Center to assist aspiring entrepreneurs to establish small

businesses based on the reservation which will employ area residents. The

Fort Belknap Small Business Development Center - Business Incubator has

been a successful, albeit limited program offered by the Fort Belknap Community

College for several years. It is funded by the Tribal Community Business

Council and the U.S. Department of Commerce - Small Business Administration.

In the past it has been staffed principally by only a Director and an assistant.

The HUD Grant has funded two additional full-time

positions, a Marketing Specialist and a Computer Technician. Both positions

were filled by local individuals who both have Bachelor degrees in Business

Administration. The Business Incubator’s new Computer Technician is

proficient in all computer applications, hardware/software and computer

networking. The Marketing Specialist has a tremendous interest and enthusiasm

in applying business skills and abilities in accomplishing the goals and

objectives of the Business Incubator Project. The goals and objectives

of the project include significant marketing and outreach to attract promising

business candidates to learn about and participate in the classes and workshops

offered from September 1999 - April 2000 to accelerate the growth potential

and success of potential entrepreneurs. Courses/workshops offered cover:

Contracting, Business Plan Development, Business Start-up, Consumer Credit,

Intro to Windows, Excel, Access, Parenting, Web Page Design, Internet I,

Reservation Resources, Forming Cooperatives, Community Development Training,

Quick Books, and Native American Loan Resources. The classes will be changed

and updated as necessary and offered again next fall. The new project’s

Marketing Specialist is in charge of Networking with banks and lenders

who are located along the outside boundaries of the Fort Belknap Indian

Reservation, in an effort to make their loan resources accessible to the

residents of Fort Belknap. A one-day workshop has been scheduled for June

28, 2000, inviting all lenders to present their programs to all interested

community members of Fort Belknap. Also, the Marketing Specialist, with

the assistance of the SBDC staff, developed an assessment tool that is

being used to evaluate and assess the needs of the existing businesses.

This assessment is presently in progress and the plan is to have the assessment

of the core clients of the business incubator completed by the end of June

2000. The Fort Belknap Business Incubator is an "incubator without

walls." Its clients have full access to the computers in the SBDC

computer lab, the telephone, fax, copier, and may request assistance from

any one of the four staff at the SBDC. Business cards and flyers are developed

at the client’s request and with assistance of staff. The SBDC has

a well stocked business resource library furnished by the U.S. Small Business

Administration. Resources include books on any type of business an individual

may want to go into. The computer lab has the latest software programs,

giving the clients access to the latest in computer technology. The Computer

Technician is in the process of developing a Newsletter for the SBDC. The

Business Incubator clients will be featured in each of the issues throughout

the year. The News Letter will also feature a community events calendar

and a "Business Appreciation Day." The business "incubator

without walls" concept is very successful at Fort Belknap. The HUD Grant has funded two additional full-time

positions, a Marketing Specialist and a Computer Technician. Both positions

were filled by local individuals who both have Bachelor degrees in Business

Administration. The Business Incubator’s new Computer Technician is

proficient in all computer applications, hardware/software and computer

networking. The Marketing Specialist has a tremendous interest and enthusiasm

in applying business skills and abilities in accomplishing the goals and

objectives of the Business Incubator Project. The goals and objectives

of the project include significant marketing and outreach to attract promising

business candidates to learn about and participate in the classes and workshops

offered from September 1999 - April 2000 to accelerate the growth potential

and success of potential entrepreneurs. Courses/workshops offered cover:

Contracting, Business Plan Development, Business Start-up, Consumer Credit,

Intro to Windows, Excel, Access, Parenting, Web Page Design, Internet I,

Reservation Resources, Forming Cooperatives, Community Development Training,

Quick Books, and Native American Loan Resources. The classes will be changed

and updated as necessary and offered again next fall. The new project’s

Marketing Specialist is in charge of Networking with banks and lenders

who are located along the outside boundaries of the Fort Belknap Indian

Reservation, in an effort to make their loan resources accessible to the

residents of Fort Belknap. A one-day workshop has been scheduled for June

28, 2000, inviting all lenders to present their programs to all interested

community members of Fort Belknap. Also, the Marketing Specialist, with

the assistance of the SBDC staff, developed an assessment tool that is

being used to evaluate and assess the needs of the existing businesses.

This assessment is presently in progress and the plan is to have the assessment

of the core clients of the business incubator completed by the end of June

2000. The Fort Belknap Business Incubator is an "incubator without

walls." Its clients have full access to the computers in the SBDC

computer lab, the telephone, fax, copier, and may request assistance from

any one of the four staff at the SBDC. Business cards and flyers are developed

at the client’s request and with assistance of staff. The SBDC has

a well stocked business resource library furnished by the U.S. Small Business

Administration. Resources include books on any type of business an individual

may want to go into. The computer lab has the latest software programs,

giving the clients access to the latest in computer technology. The Computer

Technician is in the process of developing a Newsletter for the SBDC. The

Business Incubator clients will be featured in each of the issues throughout

the year. The News Letter will also feature a community events calendar

and a "Business Appreciation Day." The business "incubator

without walls" concept is very successful at Fort Belknap.

2000-1949 W2ASACT - Montana's Water, Wastewater

In 1982, a group of professionals from state,

federal and non-profit organizations, which finance, regulate, or provide

technical assistance for community water and wastewater systems, decided

to coordinate and enhance their efforts. This informal group calls itself

the "Water, Wastewater and Solid waste Agencies Coordinating Team"

or W2ASACT for short. Recently, the focus has broadened to include Solid

facilities. W2ASACT meets bimonthly to find ways to improve our state’s

environmental infrastructure, coordinate delivery of information and services

and to coordinate funding and the grant/loan application process.

All of the agencies in W2ASACT administer

programs that meet unique needs and have different legislated and regulatory

requirements. The funding programs have common elements: money (grants

or loans), environmental infrastructure, and applications. While W2ASACT

cannot change State or Federal legislative and regulatory requirements,

it can identify duplications of effort and eliminate or reduce the problems.

W2ASACT, by reducing red tape and working together, saves communities time

and money by aligning the right programs with the right projects at the

right time.

2000-1950 ROCC Resource Occupation & C

Action For Eastern Montana, Inc., in Glendive,

Montana, has received a Rural Housing and Economic Development Grant in

the amount of $126,766. Funds will be used to develop and implement a Resource

Occupation and Career Center. Glendive, is located in eastern rural Montana

on Interstate Highway 94, 423 miles east of Helena, where HUD’s Montana

State Office is located. Helena is also Montana’s Capital City. Action

For Eastern Montana, a not-for-profit CDC serves 11 very rural counties,

several of which form Montana’s border with North Dakota and South

Dakota. Job training and self-employment skills, vital to stabilize and

stimulate the areas economy, will be targeted to single parent households,

displaced homemakers, dislocated workers and victims of farm failures in

frontier communities. Activities will include office setup, purchase of

equipment, job and skills training sessions, incubation of new business

ideas. The results of the program will be the creation of jobs and businesses.

This program will serve Carter, Daniels, Fallon, Garfield, McCone, Prairie,

Rosebud, Sheridan, Treasure, Valley and Wibaux Counties. In-kind leveraging

resources total $14,733 and technical assistance and small business loans

in support of this program. The ROCC Project established goals to be completed

during the first year: 1) Hire staff to carry out the proposed activities.

2) Introduce the ROCC concept in 4 of the larger communities and research

locations in other towns with population s less than 2500 to determine

the availability of facilities that will meet the ROCC design. 3) Create

business plan for retail stores that will be used for work experience for

hard-to-employ individuals. 4) Develop and implement training programs

for staff. 5) Develop partnerships with appropriate organizations. 6) Purchase

FF&E and necessary materials and open ROCC. 7) Advertise program, develop

and distribute brochures to all area businesses and industries and other

interested organizations/parties. 8) Identify and secure agreements and

implement work experience and apprenticeships. Identify and implement job

skills training and self employment sessions. 9) Establish a resource network

to link technology, marketing and investigation processes through telecommunications,

connecting community, state and federal entities. 10) Establish and implement

oversight monitoring procedures, by follow-up on participants and documenting

progress. Terms would be determined on an individual basis. EACH PARTICIPATN

WILL BE REQUIRED TO COMPLETE AND EVEALUATION. Participants will be able

to attend/participate in several Labs designed to meet individual requirements.

The Labs will include: A Career Planning and Assessment Lab with a full

array of assessment tools beginning with TABE (Test of Adult Basic Education).

An Adult Basic Education Lab. A Job Skills Education Lab which will even

offer a SAGE Truck Driving School as one option available. The Computer

Training Lab. Product Development Lab complemented by NxLevel MicroBusiness

Entrepreneur, Youth Entrepreneurship, Open to Thrive, etc. workshops offered

by Program Specialist.

2000-2768 Fort Peck Electric Utility Innovative Energy

The overall mission of FPEU is to provide

reliable, low-cost electricity to al customers in its service territory

in a culturally and environmentally sensitive manner. In addition, they

offer energy efficiency services. By doing so, FPEU will ultimately lower

electrical demand and consumption, which will lower electric bill to customers.

2000-2982 Montana Fair Housing, Inc.

Montana Fair Housing (MFH) is a non-profit,

grassroots organization serving Montana, North Dakota, South Dakota and

Wyoming. Since its inception in 1988 MFH has a rich history of fighting

housing discrimination in the state. In l994 MFH received their first FHIP

multi-year award which allowed the organization to expand their outreach,

education and enforcement activities. MFH is currently receiving funds

under another FHIP grant under the Private Enforcement Initiative/General

component. MFH utilizes this grant to prevent, reduce and eliminate housing

discrimination in Montana, North Dakota, South Dakota and Wyoming. This

is accomplished through complaint intake, victim counseling and assistance,

complaint preparation, education and outreach to the public through workshops,

public service announcements, pamphlets, quarterly newsletters and community

contacts with individuals, organizations and housing providers.

2000-386 Native American Properties Assessment Pilot

From December 1999 to April 2000 HUD's Real

Estate Assessment Center (REAC) conducted a pilot program in conjunction

with the Office of Native American Programs (ONAP) and the Blackfeet and

Salish-Kookenai Indian Tribes to test the effectiveness of HUD's electronic

physical assessment system on subsidized properties on Indian lands. The

HUD protocol developed by REAC currently offers standardized physical inspection

and inventory control for public housing administrators and multifamily

property owners nationwide. Housing agencies on Indian lands have not been

included in the new assessment programs however. The Blackfeet and Salish-Kookenai

tribes, recognizing the importance of accurate, objective assessment data

agreed to test the new HUD protocol. A sample of approximately 10 properties

were inspected at each reservation. The data was analyzed, scored and complete

inspection reports were provided to the tribal housing authorities and

to ONAP.

Return to

Best Practices 2000 Winners List

Content Archived: April 20, 2011 |